Determining trade size in Forex is one of the single most important factors in being a profitable trader. Position sizing is the process of determining the optimum amount to invest in a currency pair. You have to decide what trade size is optimal that results in obtaining the most profit from the trade. Traders must decide the trade size that is in conformity to their risk appetite. In order to decide the optimal trade size you have to first know how it is calculated.

The steps involved in calculating trade lot sizes are described below.

- Step 1: Identify the Tick Size and Tick Value

- Step 2: Identify How Much Capital You Wish to Risk

- Step 3: Identify Stop Loss Size

- Step 4: Calculate Trade Size

Step 1: Identify Tick Size and Tick Value: The first step in determining the optimal trade size in Forex online trading is to find out the tick size and tick value.

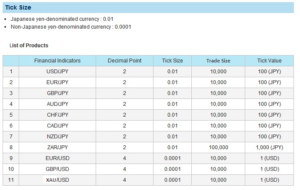

Tick size is the smallest possible change in currency prices. It remains fixed for each currency traded in the Forex market. The tick size of Non Japanese denominated currency is 0.0001 while for Japanese denominated currency the tick size is 0.01. Tick value, on the other hand is the cash value of tick size. It varies and depends on the minimum and maximum trade size set by the online Forex broker. Tick value represents the profit or loss that traders can make on movement of one tick or pips.

Step 2: Identify Maximum Acceptable Risk: You should next identify the maximum risk that you are willing to risk for a specific trade. This amount can be anything, however, experts suggest that the acceptable risk should be 1% of your trading account. So, if the account balance is $50,000 you should ideally risk $500 on a specific trade.

Step 3: Identify Stop Loss Size in Ticks:The next step in determining trade size is to identify the stop loss size in ticks. This amount depends on how much the currency value should fall after which you want the Forex trading platform to close the trade. So, if the tick value is $1 and you do not want to lose more than $10 of your amount in a currency trade, then you would set the stop loss value at 10 ticks.

Step 4: Calculate Trade Size: Having determined the tick value, tick size, maximum acceptable risk, and stop loss size in ticks, now you can calculate the trade size. The formula to calculate the trade size is as follows:

Trade Size = Maximum Acceptable Risk / 100 / Stop Loss Size (in ticks) / Tick Size

An example will help in understanding how trade size is calculated using the above formula. Suppose that you are trading XAU/USD currency pair. The maximum amount that you are willing to risk for the trade amounts to $1000 while the stop loss size is 100 ticks while the tick size is 0.0001 (non Japanese denominated currency). The trade size for the currency pair can be calculated as follows:

$1,000 / 100 / 100 / 0.0001 = $10,000

The trade size that you should order amount to 10,000 lots or $10,000. By placing a buy order the trader is stating that, “I want to buy 10K lots of Gold while selling equivalent size in US dollar”. In contrast, placing a sell order with this lot size means the trader is stating that, “I want to sell 10K lots of Gold while buying equivalent size in US dollar.”

Calculating Trade Size in Different Currencies

Calculating trade size in Forex market is simple when the trading currency used for the trade is similar to the trading capital. However, what if the trading currency used for the trade is different to the trading capital. E.g. British pounds are used to trade Euro/US Dollar currency pair. In this case, the trading capital has to be converted into the currency being used for the trade. The formula for calculating trade size then becomes as follows.

Trade Size = Maximum Acceptable Risk / 100 / Stop Loss Size (in ticks) / Tick Size* Exchange Rate

So, if you invested £1,000 in the forex market for trading in XAU/USD currency pair with the assumptions as in previous example. The trade size can be calculated as follows:

£1,000 / 100 / 100 / 0.0001 * 1.71 = $17,100 or 17,100 lots