Welcome to our comprehensive guide on successful gold trading to help you staying ahead in the gold market. In this guide, we will provide valuable insights and strategies to help you outrank your competitors and succeed in gold trading.

Understanding the Gold Market

Before diving into the intricacies of gold trading, it’s crucial to have a solid understanding of the gold market. Gold has been a symbol of wealth and power throughout history, and it continues to hold its value in today’s financial landscape. Its unique properties, scarcity, and universal appeal make it an attractive investment option for both individuals and institutions.

Gold is a precious metal that is manually extracted from the earth through mining. It is known for its inherent value and is widely recognized as a form of currency. Various factors, including both supply and demand dynamics, economic indicators, geopolitical events, and investor sentiment, influence gold’s value.

Benefits of Gold Trading

Gold trading offers numerous benefits for investors looking to diversify their portfolios and hedge against many economic uncertainties. Some of the key advantages of gold trading include:

Store of Value

Gold has consistently maintained its purchasing power over time. By investing in gold, you can protect your wealth from inflation and currency devaluation. Throughout history, gold has served as a reliable store of value, preserving wealth for generations.

Safe Haven Asset

Gold often serves as a haven asset during economic instability or geopolitical tensions. Its value rises when traditional investments, such as stocks and bonds, experience volatility. Investors turn to gold to safeguard their capital during turbulent times.

Portfolio Diversification

Adding gold to your investment portfolio can help mitigate risks associated with other assets. Gold’s low correlation with other financial instruments makes it an effective diversification tool. When the value of certain investments declines, gold can act as a counterbalance, providing stability and reducing overall portfolio volatility.

Fundamental Analysis in Gold Trading

To succeed in gold trading, conducting a thorough fundamental analysis is essential. This involves examining various factors that impact the price of gold, such as:

Supply and Demand

The balance between gold supply and demand is a crucial driver of its price. Factors that affect supply include mining output, central bank reserves, and recycling. On the demand side, jewelry, technology, and major bank purchases play significant roles.

Understanding supply and demand dynamics help traders anticipate changes in the gold market. For example, if mining output decreases or central banks increase their gold reserves, it may signal a potential rise in gold prices. Conversely, increased recycling or reduced jewelry demand may put downward pressure on prices.

Macroeconomic Factors

Macroeconomic indicators like interest rates, inflation, and economic growth influence gold prices. Central banks and policymakers play a significant role in shaping these factors. Traders can gain insights into potential future price movements by analyzing economic data and central bank policies.

Interest rates have a direct impact on the opportunity cost of holding gold. When interest rates are low, the relative attractiveness of gold increases as alternative investments provide lower returns. Inflation erodes the value of traditional currencies, making gold an appealing hedge against rising prices. Economic growth affects overall consumer and investor sentiment, influencing the demand for gold.

Geopolitical Factors

Political instability, conflicts, and trade tensions can profoundly affect the price of gold. Investors often turn to gold as a haven during uncertain times, leading to increased demand and price appreciation. Geopolitical events can disrupt global markets, impacting currencies, stocks, and other assets. Gold, a tangible and universally accepted form of value, tends to benefit in such scenarios.

When geopolitical tensions rise, or conflicts emerge, gold prices often experience upward pressure. Traders closely monitor geopolitical developments and assess their potential impact on the gold market. Understanding the geopolitical landscape can provide valuable insights for making informed trading decisions.

Technical Analysis in Gold Trading

In addition to fundamental analysis, using technical analysis is crucial in predicting short-term price movements and identifying trading opportunities. Technical analysis involves studying historical price patterns, chart formations, and market indicators. Here are some critical technical analysis tools used in gold trading:

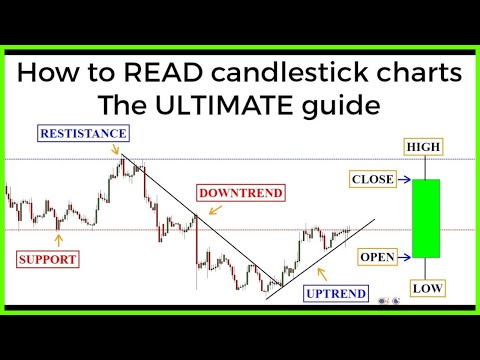

Candlestick Charts

Candlestick charts provide valuable insights into price patterns, market sentiment, and potential trend reversals. Each candlestick represents a specific time period (e.g., a day, an hour) and displays the opening, closing, high, and low prices.

By analyzing different candlestick formations, traders can make more informed decisions. For example, a bullish engulfing pattern, where a larger bullish candle follows a small bearish candle, can indicate a potential trend reversal to the upside. Conversely, a bearish engulfing pattern, characterized by a large bearish candle following a smaller bullish candle, may suggest a reversal to the downside.

Moving Averages

Moving averages help traders identify trends and filter out market noise. A moving average calculates the average price over a specific period, continuously updated as new price data becomes available.

Commonly used moving averages include the 50-day and 200-day moving averages. The 50-day moving average provides a short-term perspective on price trends, while the 200-day moving average offers a longer-term view. Crossovers and divergences between moving averages signal potential trading opportunities.

Relative Strength Index (RSI)

The RSI is a momentum oscillator that is used to measure the speed and change of gold price movements. This tool helps traders identify overbought and oversold conditions, indicating potential trend reversals. The RSI ranges from 0 to 100, with readings above 70 considered overbought and below 30 considered oversold.

By incorporating technical analysis into your gold trading strategy, you can gain insights into short-term price movements, identify entry and exit points, and enhance your overall trading decisions.

Risk Management Strategies

Successful gold trading involves effective risk management strategies to protect your capital. While trading always carries inherent risks, implementing risk management techniques can help mitigate potential losses. Here are some key principles to consider:

Setting Stop-Loss Orders

Placing stop-loss orders is an essential risk management tool in gold trading. A stop-loss order is an instruction command to automatically close a trade if the price reaches a specific level. Setting stop-loss orders limits potential losses by exiting positions when prices move against your predictions.

Determining an appropriate stop-loss level requires careful consideration of your risk tolerance, trading strategy, and market conditions. It’s essential to balance protecting your capital and allowing for reasonable price fluctuations.

Position Sizing

Proper position sizing is a crucial aspect of risk management. It involves determining the appropriate amount of capital to allocate to each trade based on your risk tolerance, account size, and trading strategy.

Adhering to position-sizing principles avoids risking too much capital on a single trade, which can lead to significant losses. Balancing potential returns and risk exposure is essential, ensuring that no single trade can harm your overall portfolio.

Diversification

Diversification is a fundamental risk management strategy for all investments, including gold trading. Instead of putting all your eggs in one basket, diversify your gold trades by spreading your investments across different gold products and, if appropriate, other assets.

Diversification helps reduce the concentration risk associated with any single investment. By allocating your capital across multiple assets, you minimize the impact of adverse events that may affect individual markets or sectors. Diversification can also provide opportunities for capturing returns from different sources, enhancing the overall performance of your portfolio.

Conclusion

In conclusion, gold trading presents an exciting opportunity for investors seeking to maximize their returns and safeguard their wealth. By understanding the dynamics of the gold market, conducting a thorough analysis, and implementing effective risk management strategies, you can position yourself for success.

Stay informed, adapt to market conditions, and continuously refine your trading skills. The gold market is dynamic and influenced by a multitude of factors. Regularly updating your knowledge and staying abreast of market trends is essential for making informed trading decisions.