To most people, having an IRA means having an investment portfolio with tax breaks. An IRA usually means having a basket of stocks, mutual funds, bonds, and other investments. What many don’t know is that it is possible to purchase physical gold and silver, such as coins and bullion, for your IRA. Major IRA companies such as Fidelity do offer this option, so if you are interested in investing in precious metals, be sure to choose a company that offers that option. If you already have an IRA, your IRA holder may not permit investment into precious metals. Not all IRA custodians give that option, so you may need to ask your custodian if they offer that option or not.

When you find an IRA that will allow gold and silver, then you have the option of including them as part of your diversification strategy. Historically, precious metals tend to do well during inflationary periods, so they may add to the long term stability of your portfolio.

There are certain federal laws and restrictions on how you may invest in precious metals such as gold or silver. A Fidelity IRA, for instance, defines a minimum investment of $2,500 and will only allow you to invest in certain types of coins, such as the Gold American Eagle, the Gold American Buffalo, and the Silver American Eagle. The American Gold Eagle coin was specifically approved for IRA investments.

Though certain IRAs may allow other forms of gold coins and gold bullion, the purity of any investment in gold and silver must be at least 99.5%. Typically, gold bullion is 99.99% pure. Gold bullion may be ideal for larger investors, since the larger the gold bar, the smaller the markup.

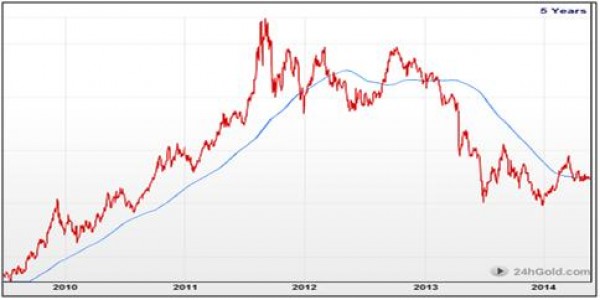

When investing in precious metals, there are several market influences to bear in mind. Supply and demand are the driving force that determines the value of precious metals, and there are a number of factors that affect this value. For instance, the potential or actual inflation of currency, the stability of politics and economics, and demand from sectors that may utilize these metals, such as jewelry and industrial uses. The precious metals market can be more volatile than other markets, yet during difficult economic times they may be just the right investment.

There are advantages to precious metals over other types of investments. Their independence from other currency and investment values can help balance your portfolio and stabilize it against market fluctuations. Finally, precious metals tend to rise as the prices of other goods and services rise. This increases your long term purchasing power. Gold and silver may be an excellent diversification strategy for your IRA that balances it against potential economic fluctuations and increases your purchasing power.