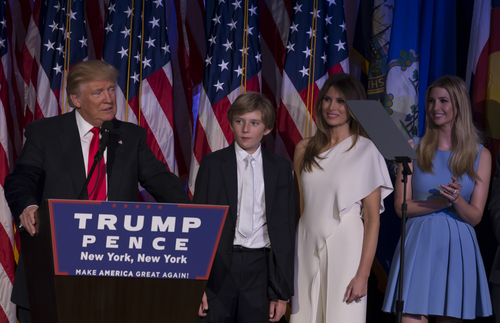

The gold market has been a thing to watch since the November 2016 U.S. presidential election. Both bullish and bearish investors have kept their eyes on where gold and precious metals are going and if today’s closing bell is any indication of the year to come, gold is on the rise.

Gold futures opened today at their highest price since mid-December, getting analysts and traders ready for a busy day ahead. The uptick in gold is a bit surprising to most as the dollar has been strong, economic outlooks are good and stocks are performing well.

Inverse Relationship

Traditionally, gold acts inversely to these indicators. As the economy grows and interest rates go up, investors tend to see more value in higher risk investments so they can reap a bigger reward. However, in the wake of the presidential election, the stock market has performed well and now gold is following suit.

As the U.S. trading market begins its day, gold investors on the other side of the globe wait anxiously to hear the results of the U.S. Federal Reserve’s December meeting. Many expect a rise in interest rates, which could lead to a downturn in the gold market. Some expectations, still modest, predict an increase of 0.75% through the 2017 year.

What Affects Gold Prices?

With that in mind, interest rates are not the only factor affecting gold prices. While interest rates might be increasing and the economic outlook is favorable, trade policies are uncertain. Gold is not expecting a decline on a one-to-one basis with interest rate hikes. With so many factors in play and uncertainty about future economic policy, the outlook for gold could be bright.

Many influential factors reside outside of the U.S. economy as well. With many European elections in the near future, the gold market in western economies could be in for an overhaul. As the year goes on, that gold market is likely to have its ups and downs. However, it has the potential to see year-over-year improvement when compared to its 2016 performance.

Investors are looking for any indicator of change in the gold market, whether it’s an election, official appointment, policy change, or tweet. The markets change minute to minute based on both hard facts and emotional reaction. As the excitement of the new year winds down in February, the gold market can begin to feel out its path for 2017.