Understanding PIPS and How they Relate to Gold Forex trading Using Online platform

Gold Forex trading using online platform requires that you understand certain basic terms to trade successfully in Forex. One of the terms, that is extremely important for you to understand is the PIPS. The value of pip is important as it determines how much of the fluctuation affects your open positions. Higher pip values depict greater volatility in the market with more risk and reward from the forex trade. Lower pip values entail less volatility that lower the risk and reward from the forex trade.

In this article, we will provide you basic information about PIPS. You will learn how to calculate PIPS while trading gold in the online Forex market.

What is a PIP?

PIP in the Forex market is an abbreviation of percentage in point. It is the smallest increment of any currency pair. One pip is the smallest change in price between the two currencies. The value of one pips is equal to 0.0001 for all currencies except Japanese yen whose value is equal to 0.01.

Thus if the difference between the currency pair increases by 0.0001 we say that there the currency pair value increased by 1 pips. However, if the difference between the currency pair falls by 0.0001 we say that the currency pair value has decreased by 1 pips.

Japanese Yen is given different denomination in PIPS because its exchange rate is extremely low as compared to other major currencies like USD, EUR, GBP, CHF, AUD etc. So, if the difference between the currency pair that includes Japanese yen increases (decreases) by 0.01 we say that there the currency pair value increased (decreased) by 1 pips.

An example will help you better understand the concept of PIPS. Suppose the XAU/USD currency pair is trading at a value of 1246.9540. If the gold value rises to 1246.9550, we say that gold currency pair has appreciated by 10 pip. On the other hand, if gold value falls to 1246.9530 we say that the gold currency pair has decreased by 10 pip. In case the gold vale changes to 1247.0000 we say that gold currency pair increased by a remarkable 460 pips.

Relationship between PIPs and Spreads

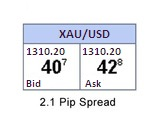

Apart from determining the amount of appreciation and depreciation of a currency pair, PIPs also help in determining the spread between two currency pairs. Spread is the difference between the bid and ask price of the currency pair. This difference in currency pair spread is also quoted in PIPs.

Bid price means the price at which the broker buys the currency pair from you, while ask price means the price at which the broker will sell the currency pairs to you. If you buy a currency pair and sell it immediately in the Forex market when no change in exchange rate takes place, you will lose money. The reason is that the bid price is always lower than the ask price. The brokers buys the currency pair from you at the bid price while they sells the currency pair to you at the ask price.

The difference between the bid and ask price determines how much profit you can make in the Forex market. Different traders allow different spreads on the currency pair.

Let’s look at an example to further understand the relationship between pips and spreads. Suppose XAU/USD pair is trading at 1326.1000/1326.1200. The first price is the bid price of gold currency pair, while the later is the ask price of the gold currency pair. The spread between the currency pair is 200 pips. (1326.1200 – 1326.1000).

So, when you go long on the currency pair, you can buy the currency pair at the ask price from the online broker i.e. 1326.1200. When you close the long position, you can sell the currency pair at the bid price from the online broker .e. 1326.1000. This means that the actual value of the currency pair should increase by more than 200 pips if you want to gain from the trade.

In general smaller pips is better in Forex trade as it requires a smaller change in value to gain from the trade.