Forex is a hypersensitive market that requires advanced trading strategies. Traders exchange trillions of dollars every day in the Forex market making it one of the most liquid markets in the world. However, not everyone is successful in this trade. Only those traders who employ advanced Forex trading strategies reap windfall returns from trading in Forex.

If you want to trade gold in the Forex market, you should know some of the advanced tips and tricks that results in accurate prediction of currency values. Online gold trading without formulating any strategy is akin to gambling. You stash your cash into Forex and just hope the market performs as per your expectation.

Remember Forex market is not a place to gamble. Leave that to Las Vegas! Trading in Forex is similar to any other trade that requires understanding the underlying market before investing in a particular currency.

In order to get you moving in the right direction, here are some of the advanced Forex gold trading strategies that will allow you to understand the market, predict the trend and gain benefit from the trade.

MACD Divergence

MACD (Moving Average Convergence Divergence) is a trend momentum indicator. It shows a relationship between two EMAs (Exponential Moving Averages). The MACD trading strategy merges momentum and trend in one indicator. Here is an advanced MACD strategy to determine the optimum levels when trading gold in the Forex market.

MACD (Moving Average Convergence Divergence) is a trend momentum indicator. It shows a relationship between two EMAs (Exponential Moving Averages). The MACD trading strategy merges momentum and trend in one indicator. Here is an advanced MACD strategy to determine the optimum levels when trading gold in the Forex market.

Basically, you buy the currency pair and go long, if the MACD graph shows a downward trend (divergence) while the price movements are actually moving upwards. In contrast, you sell the currency pair and go short, if the MACD graph shows upward trend while the price movements are actually moving downwards.

Strategy Setup

MACD -12, 26, 9

Entry Point

- Buy and go long on Gold/USD currency, if MACD graph shows bearish trend while the price of gold is moving upwards.

- Sell and go short on Gold/USD currency, if MACD graph shows bullish trend while the price of gold is moving downwards.

Exit Point

- Use a trailing stop catch to gain as much from the trend as possible.

- When you detect a reversal signal, close the current position first and onwards.

Time Frames

Any, but works best on short term duration.

Stop Loss Point

- For a buy trade, use swing low as the stop loss point.

- For a sell trade, use swing high as the stop loss point.

Pros

- Signals are easy to spot.

- Involves using one indicator only.

Cons

- Does not need setup of multiple indicators.

- Cannot be automated easily.

- No clear take profit point.

Double Cross

Double cross forex gold trading strategy utilizes MACD and moving averages to determine the best time to enter and exit a trade. You have to wait till the bar crosses before opening or closing a trade.

Double cross forex gold trading strategy utilizes MACD and moving averages to determine the best time to enter and exit a trade. You have to wait till the bar crosses before opening or closing a trade.

Strategy Setup

MACD -12, 26, 9

EMA – 5

SMA – 15

SMA – 100

SMA – 200

Entry Point

You should buy the currency pair when the following conditions are met:

- Gold prices are above SMA 100 and 200 by 25 pips

- EMA 5 crosses over SMA 15 and MACD crosses from negative to positive

You should buy the currency pair when the following conditions are met:

- Gold prices are below SMA 100 and 200 by 25 pips

- EMA 5 crosses under SMA 15 and MACD crosses from positive to negative

You should note that both the crosses are not required to occur at the same time. Although, it is required that EMA and MACD should cross within 5 bars of each other.

Exit Point

You should close any buy trades when the following conditions are met:

- MACD becomes negative

- EMA 5 becomes lower than SMA 15

You should close any sell trades when following conditions are met:

- MACD becomes positive

- EMA 5 becomes higher than SMA 15

Time Frames

1h or 4h

Stop Loss Point

There are no stop-loss or take profit point. You just have to make entry and exit at the right time to benefit from the trade

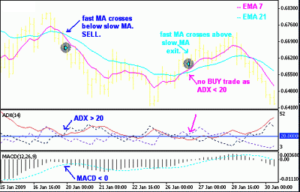

EMAs and ADX

Strategy Setup

EMA – 7

EMA – 21

ADX – 14

MACD – 12, 26, 9

Entry Point

You should buy the currency pair when the following conditions are met:

- EMA – 7 crosses EMA – 21 from above

- ADX is greater than 20

- MACD is positive

You should sell the currency pair when the following conditions are met:

- EMA – 7 crosses EMA – 21 from below

- ADX is less than 20

- MACD is negative

Exit Point

You should close any buy trades when EMA –

- EMA – 7 crosses EMA – 21 from below

- EMA – 7 crosses EMA – 21 from above

Time Frames

1h or 4h

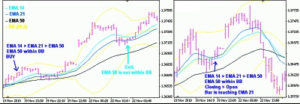

EMAs and Bollinger Bands

EMA and BB advanced forex gold trading strategy requires opening two charts simultaneously to determine the most optimum entry and exit points.

EMA and BB advanced forex gold trading strategy requires opening two charts simultaneously to determine the most optimum entry and exit points.

Strategy Setup

5 min and 1 hour chart

- EMA – 14

- EMA – 21

- EMA – 50

- Bollinger Bands – 20,20

Entry Point

You should buy the currency pair when the following conditions are met on both the 5 min and 1 hour charts:

- EMA – 14 is greater EMA – 21

- EMA – 21 is greater than EMA – 50

- EMA – 50 is within the Bollinger bands

Apart from the above, the following condition should also be met in the 1 hour chart:

- Current bar closing price is higher than the opening price

- Current bar is touching EMA -14 or EMA – 21

You should place a sell strategy, when the 5 min and 1 hour charts indicates opposite trend to those mentioned above.

Exit Point

For Buy Trade, you should exit when the following conditions are met:

- EMA – 14 > EMA – 21 > EMA – 50

- EMA – 50 is within the Bollinger Bands

- Use a trailing stop catch to gain as much from the trend as possible.

- When you detect a reversal signal, close the current position first and onwards.

Time Frames

This strategy works best on 5 min and 1 hour duration.