Moving Averages

One major challenge for both long and short term gold traders is to define their methodology. What tools and techniques can you use to make your gold-trading strategy more successful?

One major challenge for both long and short term gold traders is to define their methodology. What tools and techniques can you use to make your gold-trading strategy more successful?

As we mentioned in our article on Relative Strength Index, one gold-trading technique is watching the so-called “relative strength index,” RSI for short. But many gold traders refrain from acting on RSI figures until they have confirmed the data using another technique, the moving average crossover.

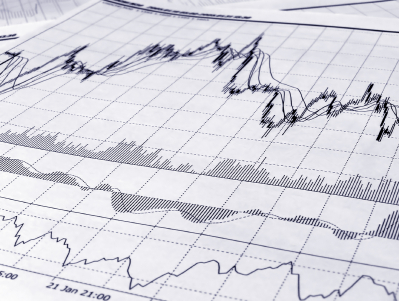

Moving average looks at gold’s average daily price over a specific period of time, anywhere from a few days to a few years. When gold moves below its 50- to 100-day moving average, for example, gold traders may believe a decline is in progress. In contrast, when gold exceeds its 50- to 100-day moving average, gold traders may believe a rally is in progress.

A moving average crossover is simply the point on a chart—often generated by an online gold-trading program—where the price of gold and gold’s moving average intersect.

Moving average crossovers help gold traders forecast future movements in gold prices so they know when to buy or sell.

Moving average crossover is a popular gold trading tool because it is easy to generate in most online gold trading programs and is easy to use.

Moving average crossover tends to work best in so-called “trending” markets, where gold prices are tending to move in one direction, either up or down.

In fact, to determine the strength of a moving average crossover, many gold traders look at trendlines. Trendlines are one of the simplest technical tools gold traders can use. Gold traders (or their online gold-trading programs) simply draw a line under gold-price highs or lows on a chart to show the prevailing direction of price. For example, a gold trader may connect a series of lows on a gold-price chart to show where gold will potentially rally. Or, a gold trader may connect a series of highs on a gold-price chart to show where gold will potentially decline. Many gold traders wait until the low trendline has been breached to execute a purchase trade, or the high trendline has been breached to execute a sale trade.