Gold is a highly desirable asset that is traded all over the world 24/7. It is a status of symbol and is used in jewelry and industrial equipment. But have you ever wondered how the price of gold is determined? It is crucial for investors new to gold trading to learn about ways in which spot price of gold is set. This will help in making the right choices when investing in gold. The price of gold fluctuates according to the demand for gold. Gold price discovery mainly takes place in London Gold Market. Gold analysts look at London gold market to set the trajectory of their gold investment strategy. Although London gold market is huge and is five times larger than Comex gold futures market in New York, the clandestine nature of its operation, lack of transparency and opacity in fixing of gold prices has made it less trustful in the eyes of financial regulatory authorities. The London Gold Fix was in the news recently when Financial Conduct Authority slapped a fine of £26 million on Barclays Bank– one of the participatory authorities in fixing gold price – for manipulation and conflict of interest in relation to gold price fixing.

So how Spot Price of Gold Is Fixed in London Gold Market?

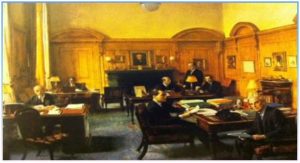

The first gold price fixing took place on Sep. 12, 1919 among the five principal gold bullion traders of the day: Mocatta & Goldsmid, N M Rothschild & Sons, Samuel Montagu & Co, Pixley & Abell, and Sharps Wilkins. These gold bullion traders fixed the spot price of a tray ounce of gold at four pounds eighteen shillings and nine pence i.e. £ 4.9375 or $23.20625. Today, the price of gold is set twice a day in London behind closed doors. Five of the largest bullion banks, who are also members of London Bullion Market Association, match up their client books each day and agree on the demand and supply of gold. Gold prices are quoted in Pound sterling (£), United States dollars ($), and European Euros (€). The five participatory banks that set the spot price of gold include:

- Barclays Capital — Replaced N M Rothschild & Sons when they abdicated

- Deutsche Bank — Owner of Sharps Pixley, itself the merger of Sharps Wilkins with Pixley & Abell

- HSBC — Owner of Samuel Montagu & Co

- Scotia-Mocatta — Successor to Mocatta & Goldsmid and part of Bank of Nova Scotia

- Société Générale — Replaced Johnson Matthey and CSFB as fifth seat

During each gold trading session, these banks decide upon spot price of gold known as ‘London AM fix’ and ‘London PM fix’ over the phone. The ‘AM fix’ is the morning gold trading price that is set in the morning at around 1030 GMT, while ‘PM fix’ is the afternoon gold price that is set in the afternoon at 1500 GMT. The highest spot price of gold was fixed on September 05, 2011, when gold price peaked at $1907.6 per ounce. However, when indexed for inflation, the highest gold price was set on January 21, 1980, when gold price reached $865.35, which is equivalent to $2445.52 per ounce in today’s monetary value. The fixing historically took place at the city office of N M Rothschild & Sons in St. Swithin’s Lane. But since May 5, 2004 the fixing of gold price takes place over the phone. The chairmanship of the company among the five banks who are involved in setting the gold price. Traditionally, the London Gold Fixing was concluded with rising of a small Union Flag at the desk. Now the proceedings ends with the participants saying “flag”, and the chair ends the meeting with the words, “There are no flags, and we’re fixed”.