The gold market correction that has taken place since 2011 is creating an opportunity for gold traders who want to own gold. A number of converging factors are preparing the way for a possible new run up in gold prices that will dwarf anything seen before. Firstly, it is important to understand that gold prices tend to run parallel to an increase in the world money supply and to the Federal Reserve asset base. Secondly, many of the world’s largest central banks have been accumulating additional gold reserves including Russia and China to name a few. Thirdly, thanks largely to the increase of global communication, gold is becoming more recognized as a store of value and universal currency and that the gold market has existed throughout history. Fourthly, the debt levels of many countries are now out of control and there are some analysts that even believe the US Dollar could lose its status as the reserve currency of the world. Watch this eye opening video which looks at the great gold market opportunity.

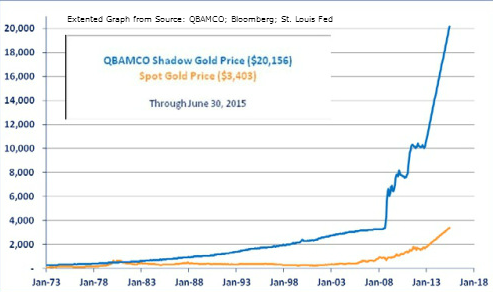

How soon could the world see hyperinflation? How unaware is the general public about why gold should be priced much higher from a fundamental perspective? One way to calculate this is to look at the gold market shadow price. In other words if the Fed were to stop printing money, what would be the fair price for gold to back the total amount of currency that is printed. In the chart below you can see the blue line represents the base of money in the world versus the total amount of gold holdings that the U.S . has in its possession. As you can see from the gold chart below , the last time the blue and yellow lines intersected was during the early 1980’s.

If sovereign countries such as Russia, China, South Korea and Japan are taking physical possession of gold bullion, can we intelligently ignore this when it comes to our own gold trading and investment strategy? It only makes sense for any gold trader to always maintain a portion of their investment portfolio (minimum 5-10%) kept in physical gold. Yes, physical gold and not paper gold. If you trade gold online and make a profit, take some of that profit and buy yourself some physical gold and hold onto it. Don’t just trade gold online….