If you are a seasoned investor, you may be aware about the boom-bust cycle that characterizes free market economy. The business cycles range from three years to as much as fifteen years duration. Investors who are able to correctly read these cycles can leverage this knowledge to gain from trading in the corporate arena.

In this article, we will take a look at the business cycle and how international investors can use them for spot gold trading in the online forex market.

How to Use Business Cycles to Determine Effective Spot Gold Trading Strategies in the Forex Market?

Understanding Business Cycles

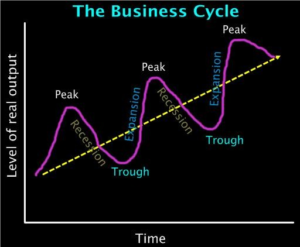

A business cycle is a recruiting phenomenon that tends to occur over a long duration. It refers to fluctuation in the economic activity and entails recovery, growth, peak, recession, and trough. Business cycle can be of any duration but normally they range from three to five years duration.

Business cycle begins with period of economic boom or growth. This period is characterized by high consumer spending, high productivity and low unemployment. With passage of time, these levels become unstable due to which profit of the companies begin to decline. Consequently, companies begin to lay off their employees to maintain their profits. This leads to decrease in consumer spending due to which overall economic activity of the country stalls and the country enters into a recessionary stage. After a while due to various government incentives and policies, economic activity of the country starts to show signs of recovery. Companies profit begins to rise, employment level increases, consumer spending also rises, and the company again shifts to a growth stage. The business cycle tends to repeat regularly lasting anywhere from 3-15 years.

Impact of Business Cycle in the Forex Market

Business cycles have a great significance for economists, investors, and policymakers. Investors strive to maximize their profit by buying low and selling high. Government policymakers and economists use various policies and tools to reverse the recession and pave the way for economic recovery. They use a combination of regulation and monetary tools to initiate the recovery process. These macroeconomic measures influence the price currency values in various ways.

Some currency pair rise in value during recessionary periods while other decline in value during such period. For instance, gold and other precious metal currency value rise in value during the time of recession while USD, CAD, JPY, GBP currency value tend to fall in value during such time. Opposite happens during economic growth and boom.

Forex investors take different position during different stage of the business cycle. During peak stage of the cycle, investors generally take a long position on USD, CAD, JPY, and other correlated currencies. While they take short position on AUD, CAF, XAU, XAG, and other similar currencies.

Contrarily, during the recessionary periods, investors tend to take a short position on USD and other related currencies while take a long position on AUD, XAG, and other correlated currency pairs.

How to Identify Business Cycles?

There are a number of ways investors can determine business cycle during a particular period. Lagging and leading economic indicators generally give a good idea of the present business cycle. Some of the economic indicator that signify periods of recession and growth include inflation rates, general employment level, GDP, CPI, CCI, and ISM. Other economic indicators that confirm the stage of a business cycle include inventory to sales ratio, and consumer debt to income ratio.

As mentioned previously, every business cycle consists of four stages growth, peak, recession, trough and recovery. Traders can look at economic indicators to determine current stage of the business cycle in the economy.

Growth-economic indicators like employment level, GDP, incomes tend to rise. Companies profits soar during the growth stage, while monetary policy focuses on encouraging private sector investment in the country.

Peak-company profits are at their highest, sales and inventory levels tend to grow at the same time, while credit is easily available for the investors. Policymakers tend to focus on curtailing inflation levels in the country.

Recession- corporate profits start to decline, credit is becomes hard to obtain, and economic activity comes to a halt. The employment, sales and inventory levels starts to fall, while the policy of the country shifts towards aggressive monitory easing.

Trough-economic indicators move in a horizontal direction, companies break even rather than making a profit, credit becomes cheap, while inventories continue their downward move. Policymakers continue their focus on monitory easing.

Recovery-Economic indicators begin to show sign of reversal. Credit is easily available for the investors, employment levels rise, consumer demand starts to pick up, and companies profit starts to move in upward direction.

Conclusion

Business cycles have a great influence on risk and returns trajectory of various investment instruments. This can also be said of spot gold trading in the forex market. Identifying the phases of business cycle and investing accordingly can have a great influence on the risk-adjusted returns of the gold currency pair in the forex market.

Generally, spot gold prices tend to rise during recession and trough periods, so you should take a long position during such stage of the business cycle. Contrarily, spot gold prices tend to fall during growth and peak periods, so you should take a short position during such stage of the business cycle.