Investors can trade in gold in the foreign exchange (forex) market. The symbol of gold in the forex market is XAU, while the symbol of dollar currency is USD. You can open an XAU/USD currency pair trade account online to trade in gold.

Trading gold and US dollars in the forex market offers various benefits. Here are some of the reasons why you should trade XAU US in the foreign exchange market.

1. Highly Liquid Market

The foremost reason you should trade gold and US dollars in the forex market is that it is the most liquid markets in the world.

Daily transaction volume exceeds $6 trillion on average. The market is about 25 times larger than the global world stock market.

All kinds of trading institutes are involved in currency trading, including hedge funds, central banks, investment companies, retail clients, and individuals. You can easily buy and sell currency pairs anytime in the forex market online.

2. Trading in Crisis

Gold prices tend to increase during an economic crisis. Gold had the reputation of being a reliable hedge during natural disasters and pandemics. Most investors and academicians consider gold as an effective safe-haven asset during an economic, political, and geopolitical crisis.

Over the years, gold value has risen and waned during different periods. But in the long run, the trajectory of gold prices has always been in an upward direction.

Gold remained on the sidelines for the most part between 1980 and 2000. There was little interest among investors since stock values were flying high. During this period, gold prices hovered between $300 and $500.

Gold value increased significantly in the aftermath of the global financial crisis in 2008. The price of gold reached a peak of $1900 per ounce in 2011. During the coronavirus pandemic, the precious metal again became a point of interest among investors as gold prices crossed $2000 in August 2020.

The price of precious metal goes higher during periods of crisis. This means that it is a reliable trading instrument during uncertain economic situations.

3. Negative Correlation

The correlation coefficient between currency pairs can be between -1 to 1 with -1 being a perfect negative correlation and +1 being a perfectly positive correlation.

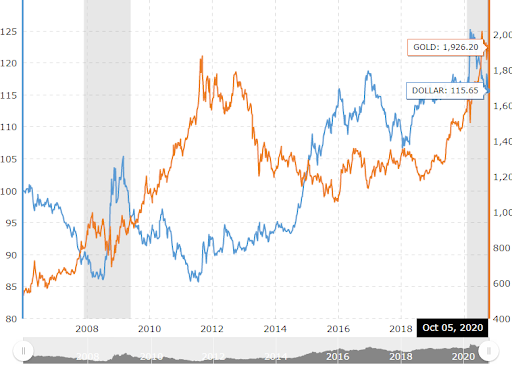

Gold and US dollar correlation is negative, which means that they move in the opposite direction. Price movements in the opposite direction provide opportunities for investors to make winning moves when trading in the forex market.

As you can see in the figure above, gold price and US dollar value are negatively correlated. The direction and magnitude of price movements are in the opposite direction.

You can make money in the forex market when the price of gold is increasing and also decreasing. When the economy is in good condition, the XAU value typically falls while the USD value rises. The opposite happens during times of economic or geopolitical distress. The opposite price movement provides opportunities for investors to open multiple positions to offset losses in other currency pairs.

4. Hedge Currency

Hedging is a trading technique to reduce losses due to unexpected movement in the market. You can apply this strategy by opening different strategic positions. Applying the hedging strategy is a great way to reduce the losses.

You can invest in currency pairs that move in a different direction to limit the losses. For instance, the USD/CAU currency pair tends to move in the opposite direction to the XAU/USD currency pair. It means that a loss in one currency pair can be offset in the movement in another currency pair.

5. Market Open 24 hours

Forex market remains open 24 hours a day and 5 days a week. You can open and close a position at any time. There is no central exchange, and all the transaction happens over the counter between the parties.

Due to long operational hours, you have more opportunities for making a profit by trading the XAU and USD currency pair.

6. Invest Any Amount

Trading in physical gold requires a large investment. The large investment requirement restricts access to precious metals. You can trade XAU and USD by investing in any amount.

The barriers of entry in forex trading are low. Anyone can open an account online by creating an account on the forex trading platform. You can open an account with a deposit of just $100.

While we don’t advise you to open an account with the minimum account, it does make forex trading accessible to everyone. The currency exchange market provides everyone the opportunity to earn a profit, depending on their means.

7. Trade Small Volumes

Investors have to trade in large volumes in traditional markets. Different exchanges have set a varied limit for transaction volume. For instance, the standard lot size in silver future is 5,000 ounces.

The best thing about the forex market is that you can trade in small trade sizes. The minimum trading size is set by the forex platform that allows a lot size as little as 1,000 units.

8. Long/Short Selling Opportunity

An inherent part of currency trading is long and short selling. You can buy or sell the quote currency in exchange for the base currency.

The price of a forex currency pair is determined by the ratio of the quote currency to the base currency. In the XAU/USD currency, XAU or gold price is the base currency while the US dollar is the quote currency.

If the XAU/USD is trading at 1905.75, one ounce of gold is worth $19075.

If you believe that the US dollar will increase, you would go long and buy the currency pair in the hope of profiting from the upward price movements.

In contrast, if you think that the US dollar value will decrease, you can go short and sell the currency pair. The profit or loss will depend on whether you have been right in your assumption about the currency price movement.

9. Low Transaction Costs

Yet another benefit of trading XAU/USD currency pair in the forex market is that it is much less costly as compared to trading in the traditional market.

There are no exchange fees, commission, or clearing fees for trading in currencies. Retain forex brokers get compensation in the form of a spread. The spread is the difference between the buying price and the selling price of the currency.

The spread charged by most forex brokers is small. You can make a significant profit on currency traders since the transaction costs are low.

10. Low Chances of Manipulation

Forex market is highly liquid with trillions of transactions made by small and large investors worldwide. The high volume makes the market difficult to manipulate by large investors.

The currency exchange market is so large with so many investors that no single investor – not even the central banks – can manipulate the prices for an extended period. You can trade using technical indicators without worrying about a government or other party affecting the currency pair values.

Strategies for Trading Gold Online

Before you trade gold online in the Forex market, you should formulate a gold trading plan. Without a trading strategy, you won’t know when to enter and exit the trade. Here are some tips for the XAU/USD pair that will help you make the right moves.

1. Determine Gold Price Movement

Historical data will let you determine future gold price movements with a high degree of accuracy. You can look at the past prices to know about the trajectory of precious metal prices.

Generally, gold price tends to move in the opposite direction of the US dollars and the stock market. Moreover, inflation and interest rate data can help you predict the future value of gold.

Typically, the gold value increases when the real interest rate (interest rate minus inflation rate) is at a low level. The traditional investment instruments provide less return when the real interest rate is low, due to which investors turn to precious metals to earn higher returns.

Conversely, the appeal for gold diminishes when the real interest rate is high. You can use this information to predict the movement of the XAU/USD currency pair.

2. Target Support and Resistance Levels

The XAU and USD pair typically trade in a range. You can identify a short or long position by looking at the previous support and resistance values. In other words, you can identify a sell or buy strategy based on previous lows and highs for a currency pair.

As gold is a relatively non-volatile asset, the precious metal is likely to reach the previous support and resistance levels. It is a low-risk strategy for making a profit through the reliable price movement of the currency pair.

3. Look at Multiple Indicators

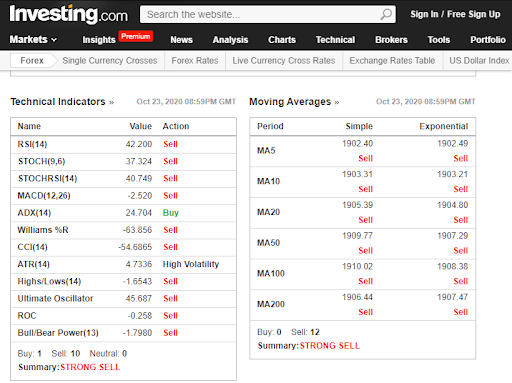

You should consider different technical indicators rather than basing the decision on any one indicator. Consider the values of moving averages, RSI, Stochastic, MACD, ROC, and others to make the right trading decision.

Look at the value of each technical indicator to decide whether to buy or sell a currency pair. For instance, all but one technical indicator for XAU/USD pair in the image above indicates a sell decision. Basing the decision on multiple technical indicators increases the chances of making the right trade decision.

4. Use Symmetrical Triangle Analysis

Symmetrical triangle analysis is also an effective technique for making XAU/USD pair trade decisions. A symmetrical triangle refers to a chart pattern that shows a consolidation that may result in a price breakout.

There is the convergence of trend lines that move in similar but opposite directions. The price movement of the currency pair will become tighter with consolidation that creates an opportunity for making a profit on the breakout point.

You should use the symmetrical triangle with other technical indicators to make a trading decision. It can offer confirmation of the other indicators regarding a price breakout. In this way, you can decide with more confidence regarding your long or short position for XAU/USD currency pair.

Final Remarks

Trading gold online involves less investment as compared to physical gold trading. The transaction costs of trading gold in the Forex market are also lower as compared to physical trading of gold.

However, gold is unlike other currency pairs in terms of fundamentals and movements. You need a different set of strategies for the XAU/USD currency pair. It is important to take time to understand the different factors that affect precious metal prices.

Trading gold in the forex market is suitable for people who understand the market. You should understand the financial and other related risks before trading gold in the currency exchange market. Traders must have the resources to withstand losses in case of adverse price movements.

Before investing in gold in the forex market, you need to be clear about the investment objectives and the risk appetite. The possibility of risk is present in the currency exchange market. Moreover, the presence of leverage increases the risks associated with trading gold in the market. You must seek the advice of an independent financial advisor if you have any doubts about currency trading in the forex market.