Economic uncertainties cause fear among investors. The 2008 financial crisis, 2009 Swine flu pandemic, and the 2020 COVID-19 pandemic had negatively affected investor sentiments.

Negative investors’ sentiment regarding the economy makes them revert to the most stable investment instrument – Gold.

Gold prices buoy up during a pandemic. During the 2008 global financial crisis and the 2009 swine flu pandemic, precious metal had provided record returns to investors between 2008 and 2011. The same happened during the 2020 COVID-19 pandemic.

Why the price of gold rises during economic uncertainties? What are the ways to trade in gold? Is online gold trading worth it? All of these questions will be addressed in this blog post.

Gold as a Hedge Against Economic Uncertainties

People invest in gold as a hedge against inflation and uncertain market conditions.

The uncertainties due to a pandemic or global financial crisis create pessimistic investor sentiment. Investors behave pessimistically when the perceived risk of investment is high. They hold their investment until the condition improves and the risk reduces.

Take the case of the 2020 coronavirus pandemic that had negatively affected stock indices all over the world. The US stocks have seen the worst fall since 1987.

Lockdowns have negatively impacted most businesses. It has resulted in a slump in economic activities. Global economic output is predicted to fall by 4 percent in 2020.

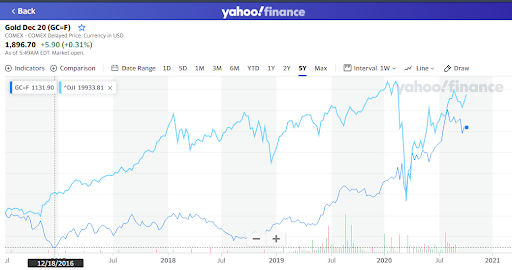

The price of gold per ounce reached a record high of $2075 in August 2020. Investors who bought gold in 2019 saw their investment value increase by about 25.32%. Those who invested five years ago experienced an ROI of about 63.23%.

The economy is not predicted to rebound to the pre-economic level until mid-2021, according to experts.

Financial Tango between the Stock Market and Gold Prices

The stock market all over the world tends to move in tandem with gold values. Historical data shows that gold prices have gone down when the stock markets are trending upwards. The opposite happens when the stock markets are trending downwards.

As you can view in the above image, gold prices tend to move in tandem with the stock market values. When the stock market prices decrease, the gold values increase. And this tango between the stock market and gold prices has continued for centuries.

Gold is a commodity rather than a security that is traded between two parties at a price that is determined by the interplay of supply and demand.

When the demand for gold is high, the gold spot price rises. The spot price decreases when the demand is low.

The demand for gold tends to inversely track the economy. During economic downturns, the demand for gold is high resulting in a gold spot prices. In such situations, investors are worried about the economy resulting in negative investor sentiment. The fear about the economy makes investors gravitate towards gold.

Gold has acted as a haven for stocks and equity funds in the 90s, the 2008 global financial crises, and the 2009 and 2020 Coronavirus pandemics.

Gold holds a special charm for investors during uncertain economic situations. The precious metal is one of the safest investment instruments in the medium and long term.

Gold prices don’t experience wild fluctuations, which are the norm in the stock markets. Although the prospect of returns is greater in stock market investment, the risk of losses is also much higher. Unlike with stocks, you won’t have to fear losing all your investment with gold.

Investors turn to gold during times of economic distress. They put most of the investment in gold to protect their savings.

Benefits of Investing in Gold

Gold investment is one of the most reliable investment instruments out there. The value of the precious metal has never experienced sharp declines. This is mainly because the supply of gold continuously increases by a small amount.

Every year gold supply increases by 2 percent due to gold exploration activities. Most of the gold that has been ever mined exists today in the form of gold jewelry, gold bars, and gold coins. This means that the gold won’t experience any wild swings in prices.

Investing in gold will help you in portfolio diversification. Gold value as mentioned previously moves in the opposite direction to financial securities. There is a negative correlation between securities and gold. Adding gold to your portfolio will help achieve diversification. Investing in gold is a great way to reduce exposure to market fluctuations. In turn, it will help you reduce the overall risk of the portfolio.

Gold involves little risk. Even as a sole investment, it will help you build your wealth over time. While the returns of a gold investment may not be as high as stock or other financial securities, the risk of losses is negligible. It can be a vital addition to a portfolio to reduce exposure to market risks.

Gold is also the best form of retirement savings as well as it helps in preserving wealth.

Currency value declines over time. Inflation erodes the value of the currency. A dollar saved about twenty years ago won’t have the same value today. In contrast, the value of gold appreciates over time. In this way, the eroding effect of inflation will be offset in the form of increased returns on gold. Realizing the benefits of gold the US Congress passed a law in 1997 that allowed the addition of gold in individual retirement accounts (IRAs).

How to Invest in Gold Today?

You can invest in gold bars, jewelry, or gold stocks. Each of these investment options has its pros and cons.

Physical Gold

Physical gold is usually a part of most people’s investment portfolio. Pure gold bars contain about 99.5 percent to 99 percent gold. You can invest in different weights of gold starting from just one gram. The standard gold bar weighs 400 troy ounces or 25 pounds. You can also buy gold bars of smaller weights with the smallest being 10 grams.

The benefit of investing in physical gold bars is that the investors have direct ownership of the gold bar. Gold bars are stored in a secure vault and so the investment is secured as well.

Gold Jewelry

Gold jewelry is another viable option for investing in physical gold. High quality, investment grade gold jewelry contains a high percentage of gold. The purity of gold jewelry is measured in karats. Higher karat jewelry has more gold content as compared to lower karat jewelry.

You should consider investing in 24 karat jewelry that contains 99 percent gold for investment purposes. The pure gold jewelry is more pliable than 22 or 18 karat gold, which contains less gold. They are typically in the form of earrings, necklaces, and brooches that are less likely to get damaged when wearing.

Jewelry can also be in the form of anklets, rings, and bracelets. However, these jewelry items generally have fewer karats, which mean there is less gold content.

Make sure you buy from a reputable gold jeweler such as Tiffany or Cartier. Also, you should consider buying jewelry from an antique store. Antique jewelry items can have exceptional value. They are typically in high demand due to their skilled craftsmanship, prestige, and unique design. The gold jewelry item will cost much more than the price of the gold they are made of.

Gold Coins

Gold coins are also a physical gold investment. You can select gold coins issued by governments around the world. These gold coins are a sound investment since they are backed by the government. However, the value of the currency is not the same as the face value. The coins are valued depending on the gold content and the prevalent market price.

You also have to pay a premium on gold coins that vary between different coin dealers. Smaller coins tend to have more premium charges compared to larger gold coins.

The weight of the gold coins varies ranging from half an ounce to about one ounce. But the most common denomination of gold coins includes 1/20 ounce, 1/10 ounce, 1/2 ounce, and one ounce.

Numismatic or commemorative gold coins are types of coins that are valued for their rarity rather than just the gold content. A study carried out by Penn State University concluded that numismatic coins provide a greater hedge than physical gold and provide superior returns.

Of the three types of physical gold, investing in gold bars is preferable due to high liquidity and lower costs. You can also invest in gold through other ways including gold mining stocks, gold mutual funds, and online gold trading.

Gold Mining Stocks

Gold trading online has gained popularity among investors due to convenience and security that it provides. Investors can trade in gold online to attain immediate ownership of gold. The practice is on the rise with many online providers offering a range of investment options for trading in gold.

Reliable companies that offer online gold trading services offer a guarantee in gold ownership. They offer 24 hours of gold trading services so that you can trade any time you like, no matter what the time is. As long as you have done your research and selected a trusted online gold trading company, you can rest assured of a safe, secure, and convenient way to trade in gold.

The benefit of digital gold trading is that you can trade gold online from anywhere and anytime. You can invest in gold online without having to worry about storage, purity, and security of gold. Each gram of gold that you purchase online is backed by actual physical gold. You can sell part of the gold if you want access to cash.

Online gold trading charges are much less compared to buying physical gold. You can redeem the gold anytime and in any amount. Trading in gold online will provide you the same benefits of inflation hedge and risk diversification as investing in physical gold.

However, note that online gold trading with contract for differences (CFDs) is not backed by any physical gold. And it is very risky. You are trading the price difference with gold and not the physical gold itself.

Summing It All Up

Gold retains its value during times of financial and geopolitical uncertainty. It is referred to as the ‘crisis commodity’ since people flee to invest in gold in dire economic and political times. And we are witnessing the same today when the economy is being ravaged by the COVID-19 pandemic.

Gold is not a volatile investment instrument. You can put as much gold in your portfolio as want. Your investment style will determine how much you should invest in this precious metal.

If you are an aggressive investor and desire maximum returns on investment, experts recommend that gold should comprise about 10 percent of the portfolio.

In contrast, if you are risk-averse and want to preserve your wealth, gold should comprise between 60 to 90 percent of the portfolio.

After you have invested in gold, you should balance the portfolio periodically to maintain the required exposure.