The future of gold and its derivative investment tools depends greatly on policies from the newly elected U.S. president. Despite the initial downturn for gold prices following the election, gold has managed to rise for the past four days. With the cabinet and other official appointments being made, the outlook for investors is becoming clearer as the days to inauguration are counting down.

Budget Director Decision

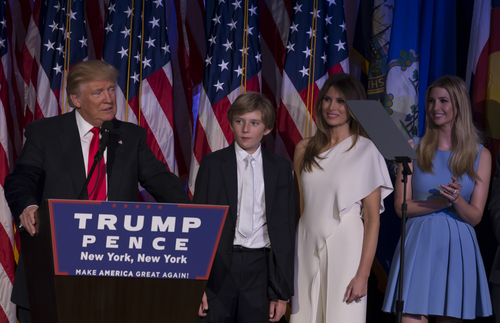

President-elect Donald Trump has been appointing his cabinet members for the past several weeks and will continue to do so until all positions are filled. One of the most recent picks included Budget Chief Mick Mulvaney. After Mulvaney was appointed as the head of the Office of Budget and Management earlier this month, his financial holdings have been under great scrutiny.

It is well known that the soon-to-be Director is in favor of budget cuts and his personal investment strategy reflects his fiscally conservative views. As an apparent hedge against another financial crisis, Mulvaney had deep investments in gold and other precious metals. According to public filings, the newly appointed Director had up to $100,000 in gold and precious metals in 2015 plus an additional $250,000 to $855,000 worth of stocks in mining companies. Despite a recent divestiture in some of his precious metals investments in June, Mulvaney still has a significant stake in the industry.

Mulvaney’s Influence on Gold

It is clear that Mulvaney puts significant value in gold and related mining and precious metal investments. His view on gold may spur investors to turn to gold, pushing prices and futures back up. Without a firm understanding of how Mulvaney’s policies will affected the value of the dollar and investments, most of this added value is based on emotional response and speculation.

While the President, much less the Director of the Office of Budget and Management, does not influence the decisions made by the Federal Reserve, both could still have an impact on other policies outside of quantitative easing and interest rate hikes that can influence the price of gold. While conflicts of interest may be removed — although it is unclear what that will entail — the officials’ stance on gold and precious metals will remain.

The Gold Market Post Inauguration

Once the President is sworn into office, he and his appointments will begin their work removing old policies, designing new ones and altering existing strategies. The market for gold will certainly change, whether it comes from interest rates, USD valuation or international trade policies.