The first decade of the 21st century ushered a golden era for gold as gold prices reached unbelievable heights. Gold is the most precious metal that is prized for its certain unique properties. These properties make gold an essential investment option to diversify the investment portfolio and protect the savings from a number of market risks. These risks include currency failure, investment market declines, inflation, burgeoning national debt, and social unrest.

Investors usually invest in gold to hedge their savings against these risks and to receive stable returns. With the surge of online gold trading, gold has also been gaining popularity in Forex trading.

Basics of Gold Forex Trading

You may already know that Forex (foreign exchange) is a worldwide, decentralized financial market for trading currencies. The Forex trade is a huge financial market with daily transactions of around $5 trillion in a single day. Forex trading volume is three to four times as compared to the trading volume of stocks and futures combined.

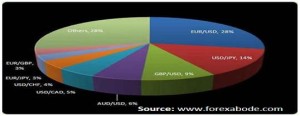

Traders trade in currencies in the form of pairs e.g. EUR/USD, USD/JPY, and GBP/USD etc. Trading in pair means that you are buying one pair and selling the other. The first currency in the pair represents buying currency while the second pair represents selling currency.

The following are eight most traded currencies in Forex:

- United States Dollar (US$ : USD)

- Euro (€ : EUR)

- Japanese Yen (¥ : JPY)

- Great Britain Pound (£ : GBP)

- Switzerland Franc (CHF)

- Canada Dollar (C$ : CAD)

- Australia Dollar (A$ : AUD)

- New Zealand Dollar (N$: NZD)

All currency pairs are “quoted” in pairs. Therefore, if EUR/USD is quoted as 1.3600, it means that it will take $1.36 to buy one euro. You buy the currency at the Ask price and sell it at a Bid price.

Two common positions in online Forex trading include Long and short position. Long position means that the trader is expecting to profit from the rise of a currency pair. Short means the trader is looking to profit from fall of the currency pair.

Furthermore, there are two different types of Forex market: Spot market and futures/forward market. Spot market is the largest market that deals with spot or current prices, while future/forward market deals with contracts for a specified future date.

So, if traders take a long position against EUR/USD, they would be buying EUR while selling USD with a hope that the quote price will rise. Opposite is the case with short position, where traders would be selling EUR while buying USD with expectation of gaining from the fall in currency value.

Role of Gold in Forex

In Forex market, gold is also considered as a currency with the symbol of XAU. It is mostly paired with USD in the form of XAU/USD trading. When the dollar is expected to lose its value, most investors take a long position on the pair. What it means is that they will buy XAU while sell USD. Contrary happens with the rise of USD value.

People invest in Gold with the intention of hedging their investments against foreign exchange risks. As the value of the dollar weakens, gold rises in value. Savvy investors see it as an opportune time to invest in gold to offset the losses in other currencies.

As rising prices for goods has weakened the buying power of many currencies, gold prices have continued to rise, allowing gold to keep it’s purchasing power. Trading in gold and gold futures help investors balance their portfolios; this protects them from the effects of inflation and the day to day fluctuation of foreign currencies.