Gold traders and investors have to remain aware of things around the world that might have an impact on prices. This helps with the goal of buying low and selling high. There are two issues on the global radar right now that people interested in gold must watch – the United States economy and the London benchmark debut.

The United States Economy

Gold prices have been moving up a bit and then back down again. For the most part, the price of gold futures has been remaining fairly consistent week over week. One of the biggest factors impacting gold prices right now is the United States economy.

The U.S. dollar slipped this past week because of a notice that the federal government isn’t in a rush to hike up interest rates. This led investors to think twice about where they have placed their holdings.

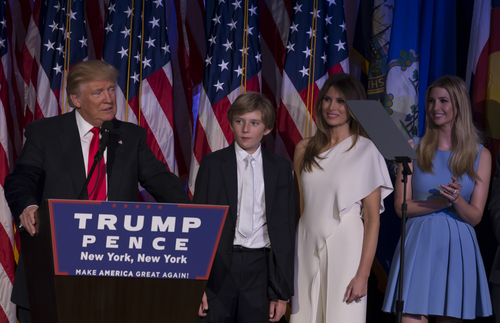

The country’s economy is also being affected by other areas of the government. The effects of President Donald Trump’s actions, including his travel restrictions and the court battles that ensue, impact the economy. Some areas of the economy, including the travel industry, are suffering because of the fear Muslims have of the wishy-washy restrictions. All of this is impacting the price of gold in the same vacillating manner.

London Benchmark Delay

The Intercontinental Exchange was planning on opening up the way for the London benchmark at the beginning of April. As it turns out, not all participants are ready. This led to a delay of the opening until June. The move could weaken the ICE’s bid for this benchmark to lead the way in gold trading based out of London.

Where Are Gold Prices Headed?

As of Tuesday, March 21, 2017, gold prices are slightly up. Spot gold is up .75 percent. Gold futures are up anywhere from .73 to 1.35 percent, depending on the trading platform. This slight increase is a step in the right direction for the precious gold metal. Investors need to keep a close eye on the U.S. and the London benchmark in upcoming weeks.