Citigroup analyst Heath Jansen has expressed heavy doubts in the long-term viability of very recent gold price gains. Since gold hit its highest price since the 1980’s in August of 2011 at $1859.30, it fell to $1213.50 before rebounding slightly to its current rate of $1316.50 per ounce. Mr. Jansen, along with several other Citigroup analysts, has predicted that gold prices will fall significantly below their average 2013 price of $1,250 in 2014 and while they do not get into specifically how far gold prices could fall, other financial institutions have noted similar predictions and financial powerhouse Goldman Sachs has said that a drastic fall to below $1,000 an ounce is not out of the question. Goldman Sachs also stated that it is likely that gold will continue its steep decline much longer than just 2014. There is a hint of irony to this story as many faux-investment gurus have talked up the ever constant value of gold for years following the financial crises in 1999 and 2007, and now those who took their advice are seeing steep drop offs in the value of their investment premiums. One has to wonder how well-advertised gold proponent Glenn Beck feels about the recent price drops.

Reasons Behind the Gold Price Drop

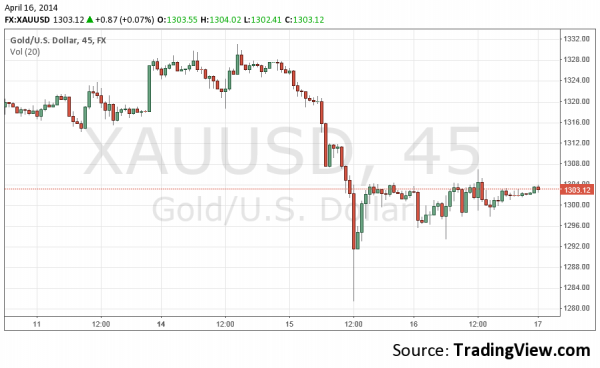

While ascertaining the exact reason or reasons for any gold prices drop, the most recent decline is tied to the improving US economy as well as forecasters predicting the recent gains in unemployment and manufacturing growth to continue. In recent meetings with the Federal Reserve Board, it has been implied that interest rates will remain low with the condition that inflation continues to stay at a low rate. Until the official clarification that the Fed was leaning towards keeping interest rates low, the financial community was expecting a small-scale credit crunch as generally they will raise interest rates with a growing economy. Wells Fargo for example, who see most of their business done in home mortgages, was fearing for the worst as they would have significantly less capital to give out loans if the Federal Reserve increased interest rates and decreased the amount of money they were lending as well. The Federal Reserve’s announcement on September 19th that they would not be reducing the amount of bonds they are buying each month from the current $85 billion a month sent stocks through the roof and saw the Dow Jones index reach record highs. Consequently, September 19th was the date at which the recent increase in gold prices stopped and the gold prices drop began again, which implies the previously described relationship between faith in an improving economy and declining gold prices.

If the current trend is any indication, gold will continue to decrease and it may reach the pre-recession levels of under $1,000 per ounce, which is a very, very good thing for those hoping to witness a booming economy again.