Gold has had a few weeks of gain, which is a good thing for investors who have already made their investment. After the election of Donald Trump, gold prices plunged but they have slowly started coming back up. It appears that this upward trend will continue. Meanwhile, gold investors from China are wreaking havoc on the perceived impact on the economy from the EU referendum.

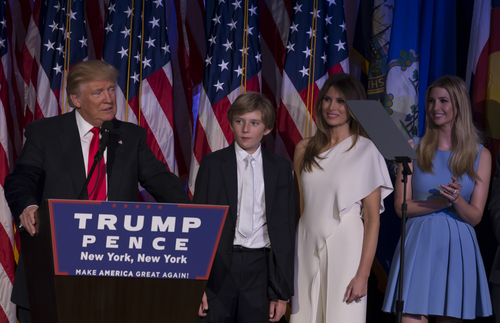

President Trump’s Speech and Gold

President Trump is expected to speak to the United States Congress this week. Gold has shown a favorable reaction to the upcoming speech, but it isn’t yet clear how gold prices and investors will react to the speech itself. Democrats are planning to troll Trump at the speech and have invited immigrants to join in as part of the crowd.

While gold did react negatively to Trump’s election, by the time his inauguration came around, investors seemed to have come to terms with the events. People started looking at the perceived value of promises he made regarding the U.S. economy. If he can fulfill his promise to strengthen it, investors will likely develop a love-hate relationship with the economic boost.

The strength of the U.S. dollar has a direct impact on the price of gold. As the dollar strengthens, the price of gold tends to decline. However, an improving economy in the U.S. means more money is spent on construction of buildings and other infrastructure. This can strengthen the price of gold.

Foreign Investors

Since the Brexit vote last June, people have been keeping a close eye on the strength of the British economy. The information available is somewhat difficult to decipher because it is skewed by foreign investors in gold. Chinese investors are buying up gold and sending it to Switzerland to have it refined into gold bars that are sized for the Chinese market, which is different from the London size.

The conundrum that Britain is facing pertains to how the increase in foreign exports looks good on paper. Each gold bar that heads to China via a Swiss refinery is a negative mark to the asset count.

Future Looks Bright

The future of gold prices looks bright. Even though countries that have a big impact on gold prices are undergoing many changes, it doesn’t seem like gold is going to head into another downward spiral. Gold prices have finally returned to where they were prior to Trump’s election. Investors who have already invested can probably look forward to seeing increases, while people thinking of investing likely won’t see another slump like the one from which gold just recovered.