Mark Douglas, renowned author of the book “Trading in the Zone”, once quoted that 95% of trading errors that you make will cause your money to evaporate within a matter of seconds. The failure stems from four main trading fears that include:

- Fear of Being Wrong

- Fear of Missing Out

- Fear of Losing Money, and

- Fear of Leaving Money On the Table

These fears or attitudes makes you lose more of your money than you originally feared of losing. It bears a greater influence on the outcome of the trade than forex trading analysis tools and techniques.

All the above mentioned fears are present in one trading strategy that is commonly practiced in forex trading platforms especially by beginner traders. Yes, we are talking about trading in small lots in forex trading.

Here we will reveal to you why this mentality of trading in micro amounts is not a good strategy to use in forex trading platforms. You will know the cons of trading in small lots and also the least amount that you should trade in Forex for obtaining maximum profits.

Trading in Small Lots in Forex Trading Platforms

The Perils of Trading with Micro Amounts

The first thing you should realize is that less is not always good in forex trading. Trading in Forex is not like shopping in a mall. You are not saving money when you purchase a currency pair for less amount. The attitude that purchasing in micro lots allows you to save money is fiction in forex trade.

You cannot get the best deal by making orders in small lots. In fact ordering small lots of a large number of currency pairs will land you into hot waters sooner than making large orders of small number of currency pairs.

You are most likely to over leverage in ordering small lots of a number of currency pairs. And in case most of the trades do not move as expected, you will have to bear a large amount of loss from your trades.

So, What is the Best Approach for Trading in Forex Market?

A better attitude is to focus on maintaining your wealth by minimizing the amount of leverage you utilize on your forex trading account. This best acheived by using fewer currency pairs when trading in the forex market. It will also reduce the time utilized in analyzing currency pairs using technical analysis tools. Many highly skilled traders will focus solely on the major currency pairs along with trading gold or the XAU/USD.

Trading in small amounts such as $1,000, $2,000, or even $5,000 is not allowed by a number of online forex trading platforms. The reason is that trading in such small amounts does not allow you to trade in forex with a positive risk reward ratio. Trying to extract money from the forex market using small lots is like trying to drink milk from a small spoon instead of drinking from a mug or cup.

To sum up, trading in small lots limits your ability to earn profit from the trade. Some of the reasons for this mentality include –

- Having a short term horizon

- Taking too little risk

- Looking at the big prize without investing enough

These attitudes will result in loss of almost all of your money rather than protecting it from loss. The opposite mentality will allow you to focus on the long term trading horizon and exploiting maximum from the market condition while also minimizing the risk.

In forex and online gold trading, you should always think of risk first rather than the amount invested in the account. Investing in a small number of currency pairs in suitable amounts will allow you to minimize risk while maximize gains from the trade. In this way you will also have a clear entry and exit points for the trades that will allow you to trade in the forex with sniper forex strategy.

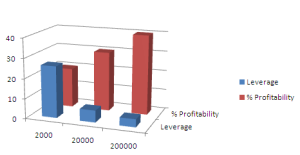

You should focus on a small number of high probability trades to obtain maximum benefit in forex trade. The less amount you trade in the online forex trading platform, more is the chance of using higher leverage to obtain greater profits. This is appropriately depicted in the graph below.

You can see from the graph above that higher leverage is utilized when small amount is invested in the forex trading. This also results in obtaining minimum profit from the trade. On the other hand, trading in larger amounts results in greater profits while also requiring less leverage. Utilizing leverage will shift your focus to short term horizon. The problem with focusing short term gains is that you will miss out on the opportunity of making large profits. And in case of unfavorable movement, it will result in greater loss due to using greater leverage on trade.

Conclusion

Trading in small lots can be more expensive for you in the long run. We opened the article on fears that leads investors to trade in small lots. You have to overcome those fears if you want to gain maximum profit from trading in the forex trading platform. So, the question is do you want to gain profit or lose your entire amount in forex trading?

The above will hopefully help you in making the correct decision for trading in the forex market. You can view the following video to learn how to successfully grow your small Forex account in forex trading.